Shining Light on a Historic Program – Duty Drawback

Every year, US Customs and Border Protection reports that as much as 85% of eligible duty refunds remain unclaimed. If you are both an importer and an exporter, it’s possible that you’re not maximizing your profits and could be missing out on a substantial amount of refund dollars. This is where Duty Drawback comes in. This week, Scarbrough Consulting’s Global Trades Services Division is featuring Duty Drawback as one of the exciting services we currently offer.

What is Duty Draw Drawback?

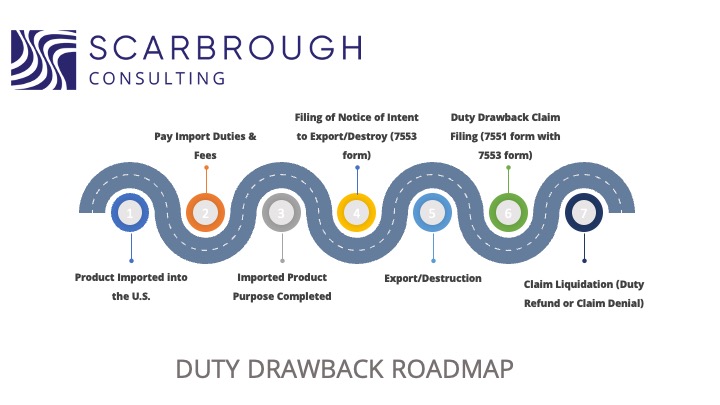

Duty Drawback refers to the process of getting a refund for Customs duties paid on imported goods that are later exported out of the United States, or for goods that have been manufactured using those imported items and then exported. Importers may receive a refund of up to 99% of their previously paid duties. This refund can be claimed retroactively for a period of up to five years by the shipper.

Options to Consider

There are two ways to approach Duty Drawback:

The first is a one-off claim, which involves exporting equipment that was brought into the country within the last five years. To make this claim, we submit a 7553 form to US customs, which notifies them of our intent to export or destroy the equipment. Customs will either examine the freight or waive the examination before signing off on the claim. Once the equipment is out of the country and we have proof of export, we file the actual claim (a 7551 form) along with the original 7553 form, import paperwork, and all export documentation. Customs then reviews the claim and provides a refund.

The second option available is Privileges, which offers more extensive benefits to our clients. This option is highly advantageous in several ways. First and foremost, we have an application process that we complete on behalf of our clients and submit to customs. Once it is fully approved, our clients can claim any Duty Drawback for products shipped out of the country up to five years ago, provided we have applied for the one-time waiver. Additionally, Privileges eliminate the need for clients to submit the 7553 form to customs. Moreover, clients have the opportunity to apply for accelerated payment, which can speed up the refund process. Overall, this program is quite impressive and offers great benefits.

The Consulting team in the Global Trades Division oversees the entire process, establishing a personalized connection between the client and a Scarbrough specialist. This level of attention may be difficult to come by in this industry. We are delighted to offer this valuable service and believe it deserves more attention. Our goal is to help our clients benefit from refund opportunities that they may not be aware of.

If you believe you could benefit from this opportunity, please contact our team! We’re dedicated to offering you valuable advice on your options and guiding you through the entire process.