The U.S. Generalized System of Preferences (GSP) FAQ

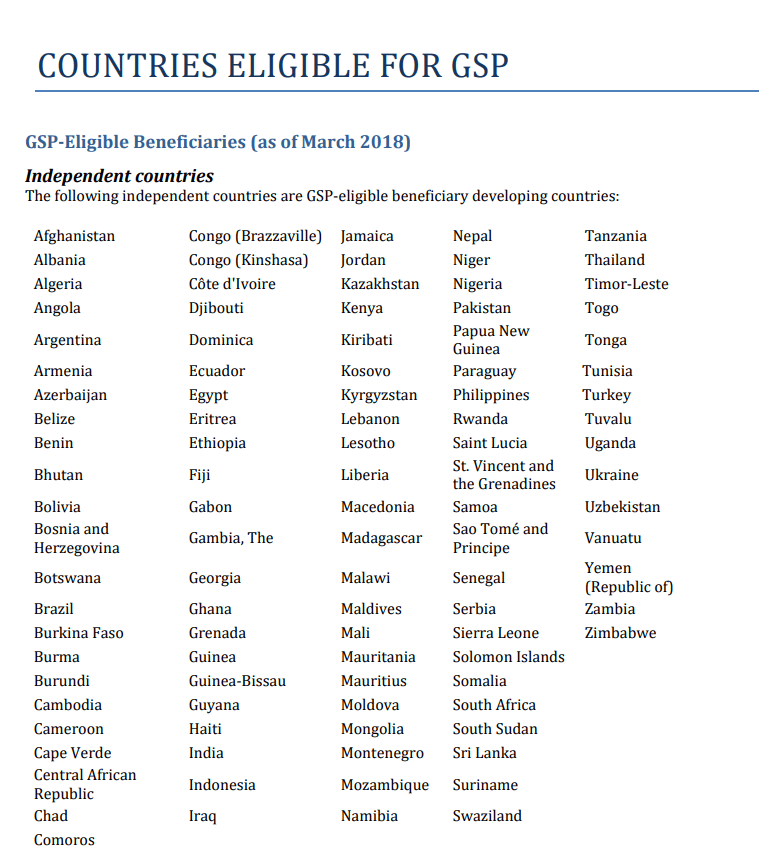

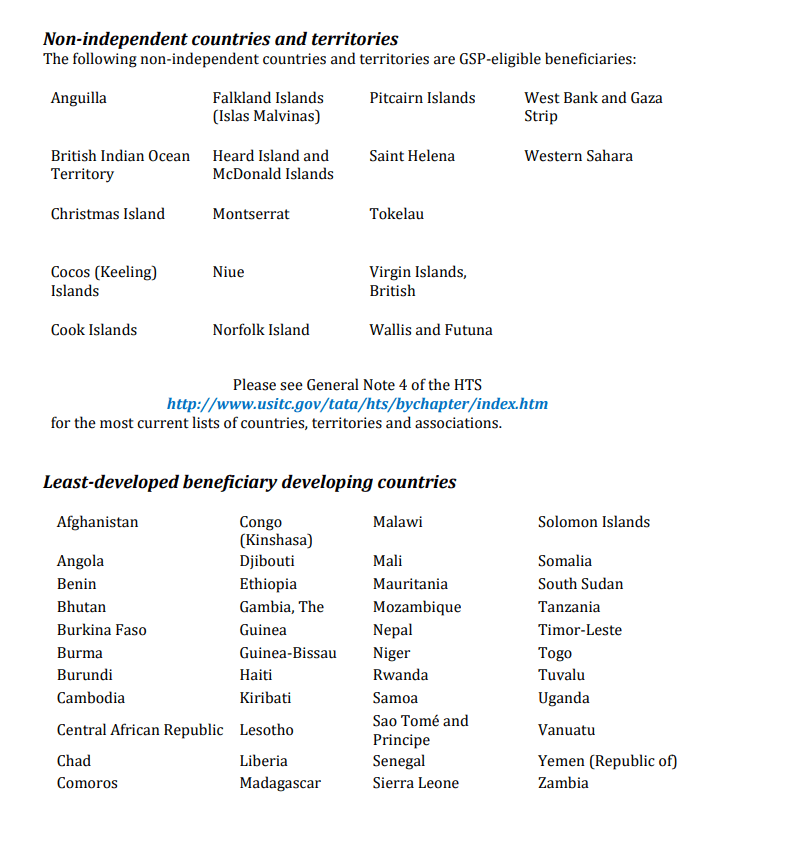

The U.S. Generalized System of Preferences (GSP), a program designed to promote economic growth in the developing world, provides preferential duty-free treatment for over 3,500 products from a wide range of designated beneficiary countries (BDCs), including many least-developed beneficiary developing countries (LDBDCs). As of March 2017, there were 120 BDCs, including 44 LDBDCs. See General Note 4 of the U.S. Harmonized Tariff Schedule for the most up-to-date number of GSP beneficiaries. An additional 1,500 products are GSP-eligible only when imported from LDBDCs. The GSP program was instituted on January 1, 1976, and authorized under the Trade Act of 1974 (19 USC 2461 et seq.). The program’s last authorization expired on December 31, 2017. The signed Bill will extend the program through December 31, 2020, and retroactively extend benefits to covered imports that have been made since the program lapsed.

What is the status of the Generalized System of Preferences (GSP) program?

March 2018

On March 23, 2018, the President signed legislation to renew the GSP program through December 31, 2020. While legislation to renew GSP was enacted on March 23rd, the effective date of renewal is April 22, 2018. GSP-eligible entries will enter the U.S. duty-free on, and after, April 22, 2018. Because the GSP program’s renewal is retroactive, importers may seek refunds of duties paid during the lapse of GSP authorization. In accordance with U.S. Customs and Border Protection (CBP) instructions, importers who marked their GSP-eligible articles after January 1, 2018, with the applicable special program indicator (SPI) for GSP (“A”) will receive automatic duty refunds without interest. In addition, for GSP-eligible articles that entered the United States during the lapse of GSP authorization without SPI code “A”, importers may submit a GSP duty refund request to CBP. To receive a

GSP duty refund, an importer has to file a request by September 19, 2018. Read More.

October 2018

On October 30, 2018, President Trump issued Presidential Proclamation 9813. The proclamation will implement changes to the Generalized System of Preferences (GSP). The modifications will go into effect with respect to articles entered for consumption, or withdrawn from warehouse for consumption on or after 12:01 am eastern time on November 1, 2018, and will remove GSP eligibility of certain goods and make changes to Harmonized Tariff Schedule (HTS) classifications. Read More.

March 2019

The United States Trade Representative announced its intent to terminate Generalized System of Preferences (GSP) designation of India and Turkey because they no longer comply with the statutory eligibility criteria. Read more.

Click on the image to download the full GSP Guidebook

1. GSP-Eligible Articles

Which imports into the United States qualify for dutyfree treatment under the GSP? To be eligible for duty-free treatment pursuant to GSP, an import must meet the following requirements (described in more detail below):

(1) It must be included in the list of GSP-eligible articles;

(2) It must be imported directly from a BDC;

(3) The BDC must be eligible for GSP treatment for that article;

(4) The article must be the growth, product, or manufacture of a BDC and must meet the value added requirements;

(5) The exporter/importer must request duty-free treatment under GSP by placing the appropriate GSP Special Program Indicator (SPI) (A, A+, or A*) before the HTSUS number that identified the imported article on the appropriate shipping documents (CBP Form 7501).

To find more about GSP-Eligibility, download the GSP Guidebook

2. How to Claim GSP Benefits for Eligible Articles upon Entry into the United States

How does an importer request GSP treatment? The importer is responsible for claiming the preference benefit by using the GSP’s SPI code “A” “A*”, or “A+”, as a prefix, before the HTSUS tariff-line number when completing the shipment entry documentation. (See 19 CFR 10.172.) If GSP is not claimed on the entry summary, there are other ways to claim it. One is to file a Post Entry Amendment with Customs at least 20 working days prior to

liquidation of the entry. Another method is to file a protest, as set out in 19 USC 1514. A sample of CBP Entry Form 7501, used for entry of merchandise, can be found on the CBP website.

To find what documents are required, download the GSP Guidebook

The GSP program is administered by the Office of the U.S. Trade Representative.

Public inquiries about the program may be directed to the GSP Program Office at USTR, using the following contact information:

e-mail: gsp@ustr.eop.gov • Telephone: +1 (202) 395-2974 • Fax: +1 (202) 395-9674

Public Documents concerning GSP Product and Country Practice Reviews are available online at www.regulations.gov

GSP Program Information is available at: https://ustr.gov/issue-areas/trade-development/preference-programs/generalized-system-preference-gsp